Home Ownership Opportunity Pathways System™ (HOOPS™)

The Home Ownership Opportunity Pathways System™ (HOOPS™) is an important element of the strategic roadmap for the architects of CuBit™. This, and other key initiatives show up on the strategic roadmap of Universal Real Estate Wealth Protection Solutions™, LLC (UREWPS™). HOOPS™ will rely heavily on smart contracts to help reduce costs and streamline many aspects of this system. UREWPS™ resources will enable every aspect of the creation of HOOPS™.

HOOPS™ opportunities are be offered exclusively through a non-profit corporation. For the purposes of this paper HOOPS™ and the non-profit are interchangeable. Segregating the operation of HOOPS™ from UREWPS™ enables efficient, effective, and focused compliance with consumer finance regulations. By the way this is legally and operationally structured, HOOPS™, rather than UREWPS™, may be considered a consumer lender.

UREWPS™ will seller finance housing units to HOOPS™ on a contract for deed. HOOPS™, in turn, will wrap that foundational contract inside a second contract for deed and sell it to a qualifying owner-occupant.

As the intent of the non-profit is to promote homeownership, the contract will require owner-occupancy. The contract for deed prohibits conversion of the unit into a rental. If an owner-occupant vacates the property or otherwise defaults on their contract, they may have the following options:

- Sell the property to a third party who pays off the contract in full to take ownership.

- Execute a quit claim relinquishing any ownership rights which may exist at law or in the contract, leaving HOOPS™ with unhindered ownership. This is similar to a deed in lieu of foreclosure. It legally acknowledges the disavowal of all ownership claims on the unit. Tax implications of this to a former participant may vary. HOOPS™ will systematically tilt the table to avoid damaging the homebuyer, when reasonable and possible. This quit claim option is embedded in the smart contract (the contract for deed). Executing it will require minimal effort and expense for the participant and HOOPS™. The contract also accounts for potential refunds if the participant has paid ahead on their contract. There may be a fee(s) associated with exercising this option.

- If the participant fails to make timely, current payments the smart contract will automatically convert to a state indicating the participant is defaulting on the contract. If the participant fails to remedy the default and continues to reside in the unit, the quit claim will be executed, and the participant will be converted from a home buyer to a renter. Rental terms are built into the contract expressly for this situation. The participant is automatically made party to a month-to-month rental agreement which may require deposits and non-refundable fees. The past due payments are retroactively converted into past due rents, meaning the participant is automatically in default on the rental agreement. Because the underlying contract prohibits renting, HOOPS™ will immediately initiate eviction proceedings in conformance with all applicable state and local laws.

- If the HOOPS™ is unable to make payments to UREWPS™ on a unit or units, UREWPS™ may, at its discretion, remove HOOPS™ from the contract and offer to sell the unit to investors. Investors may be given the option buying the unit or buying out the place of UREWPS™ in the contract. Regardless, the investor-buyer, as the owner, may retain or dispose of the property, as they desire, while dealing with the occupants as permitted by law.

HOOPS™ Benefits

HOOPS™ has several benefits which make it very competitive with the very best of bank financing.

- Contract for Deed (AKA land contract) – this means that the home buyer receives title to the property when the contract is paid in full.

- Payments must be made in CuBit™: The home buyer will need to convert USD (or other currency) into CuBit™.

- Zero interest: Instead of interest, the home buyer pays an annual servicing fee, which may be amortized across the payments for each year.

- Fifteen (15) year term: This means that equity accrues more quickly than on a thirty-year mortgage.

- Payment Holidays: In a traditional mortgage as soon as a homebuyer stops making their payments, the foreclosure clock starts ticking. This is true even if the homebuyer has paid up for several years into the future. In contrast with a mortgage, the HOOPS™ contract permits a homebuyer to use advance payments they have made to offset payments currently due. This feature could prove very advantageous to homebuyers who suffer unexpected financial hardships.

Servicing Costs

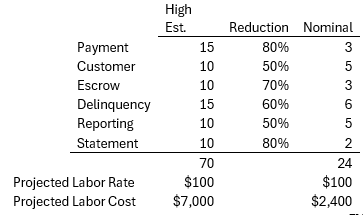

The number of labor hours required each year to service a residential mortgage depends on various factors including the complexity of the mortgage servicing, the efficiency of the servicing operations, and the technological tools available to the servicing team. Here’s an outline of the tasks involved, and an estimate of the labor hours needed for mortgage servicing:

- Payment Processing: Includes handling monthly payments, ensuring they are applied correctly, and addressing any payment issues.

- Customer Service: Responding to borrower inquiries, providing account information, and handling requests for information or changes to the account.

- Escrow Management: Managing escrow accounts for property taxes and insurance, making sure payments are made on time, and adjusting escrow payments as needed.

- Delinquency Management: Tracking late payments, sending notices, working with borrowers on repayment plans, and handling foreclosure proceedings if necessary.

- Reporting and Compliance: Preparing reports for investors, regulators, and internal management, and ensuring compliance with all relevant regulations.

- Annual Statements: Preparing and sending annual mortgage interest statements to borrowers for tax purposes.

Estimated Labor Hours

A report by the Mortgage Bankers Association (MBA) can provide some insight. According to their studies, mortgage servicers might spend an average of 40 to 60 hours per loan per year on all activities related to servicing a mortgage. This includes time spent on regular monthly tasks, managing delinquent loans, and performing all regulatory and compliance-related activities.

Breaking down the hours:

- Payment Processing: 10-15 hours

- Customer Service: 5-10 hours

- Escrow Management: 5-10 hours

- Delinquency Management: 10-15 hours

- Reporting and Compliance: 5-10 hours

- Annual Statements: 5-10 hours

These estimates are based on averages and can vary significantly based on the specifics of the mortgage servicing operations, including the use of automation and other technological tools that can reduce the labor required.

For more precise data, it would be advisable to refer to specific industry reports or studies conducted by mortgage servicing companies or industry associations.

HOOPs™ Considerations

The use of smart contracts in the mortgage servicing process can significantly affect the level of effort required for each of the six areas: payment processing, customer service, escrow management, delinquency management, reporting and compliance, and annual statements. Here’s how smart contracts might impact each area:

- Payment Processing:

- Effect: Smart contracts can automate payment processing by executing payments automatically when certain conditions are met (e.g., a specific date).

- Reduced Effort: Automation reduces manual intervention, decreasing labor hours significantly. Potential reduction by 70-80%.

- Escrow Management:

- Effect: Smart contracts can manage escrow accounts by automatically adjusting payments based on changes in tax rates or insurance premiums, and ensuring timely payments.

- Reduced Effort: Automation of adjustments and payments can reduce the need for manual calculations and processing. Potential reduction by 60-70%.

- Reporting and Compliance:

- Effect: Smart contracts can ensure that all transactions are recorded on a blockchain, providing an immutable and transparent ledger for reporting and compliance purposes.

- Reduced Effort: Simplified reporting and auditing processes due to automated and transparent record-keeping. Potential reduction by 40-50%.

- Customer Service:

- Effect: Smart contracts can automate responses to common inquiries by integrating with chatbots and AI systems, providing real-time updates and transparency to borrowers.

- Reduced Effort: Reduced need for human intervention in routine inquiries and basic account management tasks. Potential reduction by 30-50%.

- Delinquency Management:

- Effect: Smart contracts can trigger notifications and execute predefined actions when payments are missed, such as sending reminders, imposing late fees, or initiating foreclosure procedures.

- Reduced Effort: Reduced manual tracking and intervention in early stages of delinquency. Potential reduction by 50-60%.

- Annual Statements:

- Effect: Smart contracts can generate and distribute annual mortgage interest statements automatically, based on the data recorded on the blockchain.

- Reduced Effort: Automated generation and distribution reduce the need for manual compilation and mailing. Potential reduction by 70-80%.

Summary of Potential Labor Hour Reductions

- Payment Processing: Reduced by 70-80%

- Customer Service: Reduced by 30-50%

- Escrow Management: Reduced by 60-70%

- Delinquency Management: Reduced by 50-60%

- Reporting and Compliance: Reduced by 40-50%

- Annual Statements: Reduced by 70-80%

If we assume a fully loaded labor rate of $100 per hour, the table below shows the impacts of these reductions.

Source: HOOPS™ Servicing Fees Model.xlsx

Servicing Implications

The overall reduction in labor hours due to the use of smart contracts could be substantial, potentially transforming mortgage servicing into a more efficient, cost-effective, and transparent process. These efficiencies can lead to lower servicing costs, improved borrower experience, and enhanced regulatory compliance.

Additional Considerations

The use of contracts for deed (AKA land contracts) and trusts may also reduce the costs of delinquency management by automating the reversion of the contract.

HOOPS™ Considerations

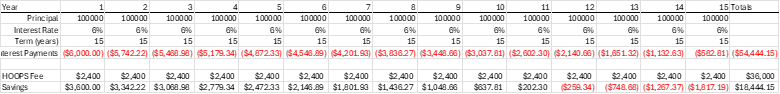

Offering a HOOPS™ seller financing package that must be paid in CuBit™ and carries and annual fee instead of any interest payments, the table below how it might look, assuming the fee is set to pay for the labor costs of servicing the contract, the loan has a 15-year term, and 6% is the comparable rate.

Source: HOOPS™ Servicing Fees Model.xlsx

With a traditional note, the homebuyer would have paid more than $54,444 in interest payments (this doesn’t include the principal payments). With the no interest HOOPS™ approach, the home buyer would have paid $36,000 in servicing fees. This would give the home buyer a total savings of more than $18,444.

This also assumes that the home buyer doesn’t refinance or sell the property. The average homeowner moves within 8 years of buying. The median is 13.5 years (Meyer, 2024). Selling at the 8-year mark would net the homeowner more than $20,647 in savings by paying the fees instead of interest. By the end of year 12, the annual interest payment is less than the fee. The negative savings hold for the last four years of the contract. However, the cumulative savings are still positive.

Although the annual HOOPS™ servicing fee is not trivial, compared to the interest payments on a similar note, it represents a substantial savings for a homebuyer. On a $100,000 home paid off in fifteen years, it represents more than 18% savings. For more expensive homes, the savings are greater, both in absolute and relative terms. A $300,000 transaction would see 42% of the purchase price in savings by paying the fee instead of interest. For a $500,000 home the savings represent 47% of the purchase price and amount to more than $236,220.

With median home values currently between $400k and $500k, the HOOPS™ approach may be extremely attractive to homebuyers. When you add in the fact that it is seller financing instead of bank financing, it may make the opportunity even more attractive.

Conclusions

The largest hurdle, from a sales perspective, may be that title to the property doesn’t pass until the contract is paid off. However, even that hurdle may be overcome by the opportunity to truly benefit from making future payments today.

Zero interest, payment holidays, avoidance of banks, and rapid payment of the contract are all powerful inducements which should make a HOOPS™ home very financially attractive.

One final concern for homebuyers is the fact that the monthly payment amount is fixed and is paid only in CuBit™. This means that as the value of CuBit™ goes up, so too does the amount of USD needed to make the monthly payment. We will undoubtedly be compelled to disclose this fact. Payment in CuBit™ is required because the CuBitDAO™ is the ultimate owner of each unit. To protect the money of DAO Members from inflation and volatility of fiat currencies, payment streams need to be stipulated in CuBit™ instead of fiat currencies.

In God we trust. All others must pay CuBit™.

References

Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. Wiley.

Bordo, M. (2019). The Case for Gold and Sound Money in the Age of Fiat. Hoover Institution Press.

Buterin, V. (2014). Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform. Retrieved from [Ethereum White Paper] (https://ethereum.org/en/whitepaper/)

Forbes, S. (2014). Money: How the Destruction of the Dollar Threatens the Global Economy—and What We Can Do About It. McGraw-Hill Education.

Friedman, M. (1984). Money Mischief: Episodes in Monetary History. Houghton Mifflin.

Hayek, F. A. (1976). Denationalisation of Money: An Analysis of the Theory and Practice of Concurrent Currencies. The Institute of Economic Affairs.

Menger, C. (1892). Principles of Economics.

Meyer, S. (2024, March 11). Average length of homeownership: Americans spend less than 15 years in one home. Retrieved from theZebra.com: https://www.thezebra.com/resources/home/average-length-of-homeownership/#:~:text=47%25%20of%20Americans%20have%20lived,homeownership%20years%20is%20eight%20years.

Mortgage Bankers Association. (n.d.). Servicing Operations. Retrieved from [Mortgage Bankers Association] (https://www.mba.org/)

Rickards, J. (2016). The New Case for Gold. Portfolio.

Szabo, N. (1997). The Idea of Smart Contracts. Retrieved from [Nick Szabo’s Papers and Concise Tutorials] (http://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart_contracts_idea.html)

©2024 Universal Real Estate Wealth Protection Solutions, LLC™ All Rights Reserved.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Ask away.

Your article helped me a lot, is there any more related content? Thanks!

Glad it helped. Check out CuBit University from the drop down menu. There you will find a link to articles and posts.

Enjoy.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Feel free to share your doubts in a comment. Perhaps we can clear them up?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks. Come again soon.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks. Come again soon, and check out our NFT offerings.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Okay. Tell me about your doubts.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Ask and you shall receive.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Sure. What is your question?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you like them. Please, spread the word.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I can help you. What is your question?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Tell me your doubts. I will be happy to address them.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I will very happily answer any concerns you have. Feel free to voice them in these comments.

Your article helped me a lot, is there any more related content? Thanks!

We will soon have the HOOPS whitepaper available for dowonload.

Your article helped me a lot, is there any more related content? Thanks!

We will soon have the HOOPS whitepaper available for download.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Ask your question.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Ask your question.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

What is your question?

Your article helped me a lot, is there any more related content? Thanks!

Lots more content is available. Use the hamburger menu on the upper left part of the screen and select CuBit University for more content.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Ask your question.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks

Your article helped me a lot, is there any more related content? Thanks!

Lots more content is available. Use the hamburger menu on the upper left part of the screen and select CuBit University for more content.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Ask your question.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Ask your question.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Tell me what you want to know more about. I will be happy to see what we can do to answer your question(s).

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me your question and I will try to answer it.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Tell me your question and I will try to answer it.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Tell me your question and I will try to answer it.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Tell me your question and I will try to answer it.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you like it. Tell your friends.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you like it. Tell your friends.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Go ahead and ask your question instead of telling me that you have a question.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Go ahead and ask your question instead of telling me that you have a question.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I have lots of answers. Let’s hope they correspond to your question. What do you want to know?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. You can find more content by clicking the hamburger menu on the upper left of the page, select CuBit University and then select Articles.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I have lots of answers. Let’s hope they correspond to your question. What do you want to know?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. You can find more content by clicking the hamburger menu on the upper left of the page, select CuBit University and then select Articles.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I have lots of answers. Let’s hope they correspond to your question. What do you want to know?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I have lots of answers. Let’s hope they correspond to your question. What do you want to know?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I have lots of answers. Let’s hope they correspond to your question. What do you want to know?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/en-ZA/register?ref=JHQQKNKN

I have lots of answers. Let’s hope they correspond to your question. What do you want to know?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you like it.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Glad you liked it. Go ahead and ask your question.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Glad you liked it. Go ahead and ask your question.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

What is your question?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

What is your question?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Go ahead and ask your question. I will answer it as best I can.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

What is your question?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

What is your question?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Great! Thank you so much for sharing this.

Glad you liked it.

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Tell me your doubts and I will try to clear them up.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

What is your question? I am happy to help you with it.

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

What is your question? I am happy to help you with it.

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

What is your question? I am happy to help you with it.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

What is your question? I am happy to help you with it.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

What is your question? I am happy to help you with it.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

What is your question? I am happy to help you with it.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

What is your question? I am happy to help you with it.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

What is your question? I am happy to help you with it.

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me your doubts and I will try to resolve them.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me your doubts and I will try to resolve them.

Your article helped me a lot, is there any more related content? Thanks!

Glad you liked it. Please, tell your friends. You can find more content by using the hamburger menu near the top left of the screen and selecting CuBit University. Enjoy!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me your doubts and I will try to resolve them.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Tell your friends. You can find related content by using the hamburger menu in the upper left and selecting CuBit University where you will find more articles.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me what concerns you about this post and I will clarify.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me what concerns you about this post and I will clarify.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Tell me what concerns you about this post and I will clarify.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Tell me what concerns you about this post and I will clarify.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Glad you liked it. Tell your friends. You can find related content by using the hamburger menu in the upper left and selecting CuBit University where you will find more articles.